Concerned about the eye-popping levels of debt in the late 1980s a few fiscal hawks had a whip-round and put up a National Debt Clock in New York City as a sober warning to passers by that America had a problem. It was spending too much. The ‘eye popping’ debt, at the time, was just $2.7 trillion. Today, post a period of fiscal and monetary largesse, it’s through $30 trillion. And going higher. The issue, though, is rates are going up. As rates go up so to do interest payments on all that debt. Up and up. As foreign holders try to shuffle away from their exposure to the USD, they are selling. The Federal Reserve is also selling. So too the Social Security Trust, one reads, a trust for workers to draw upon in the their old age. Some models suggest the Trust will be all out by the mid-2030s. And a growing base of sellers is fanning the coals of the ever thinning liquidity in the Treasury market, which makes it sticky for those doing the buying, or the selling, in any sort of size. Those more glass half full talk up a shallow recession being priced in, egged on by a year-end junket higher off the back of improving data and a more-than-up-for-it consumer; but the debt is not being paid back. And it’s being refinanced at higher rates. No politician wants to cut spending or remove entitlements because it’s unpopular. So they don’t. They carry on. And the clock in Bryant Square ticks higher and higher. Powell may be close to curbing the rate hikes that have so charred 2022, or he may be forced to squeeze the pips a bit more. The market low might be in, or not; but perhaps the real question is not ‘will the Fed pivot?’ but rather ‘are the mandarins 100% finished with their monetary voodoo in all it’s exotic guises? Straight up: ‘yes’ or ‘no’. And if yes, would you put your mortgage on it? Who knows really where it all ends – Japan and it’s stagnant bond market look on wistfully – but the numbers involved when it comes to the debt, are off the clock. The Fed may not actually have any choice. Tick, tick, tick, tick.

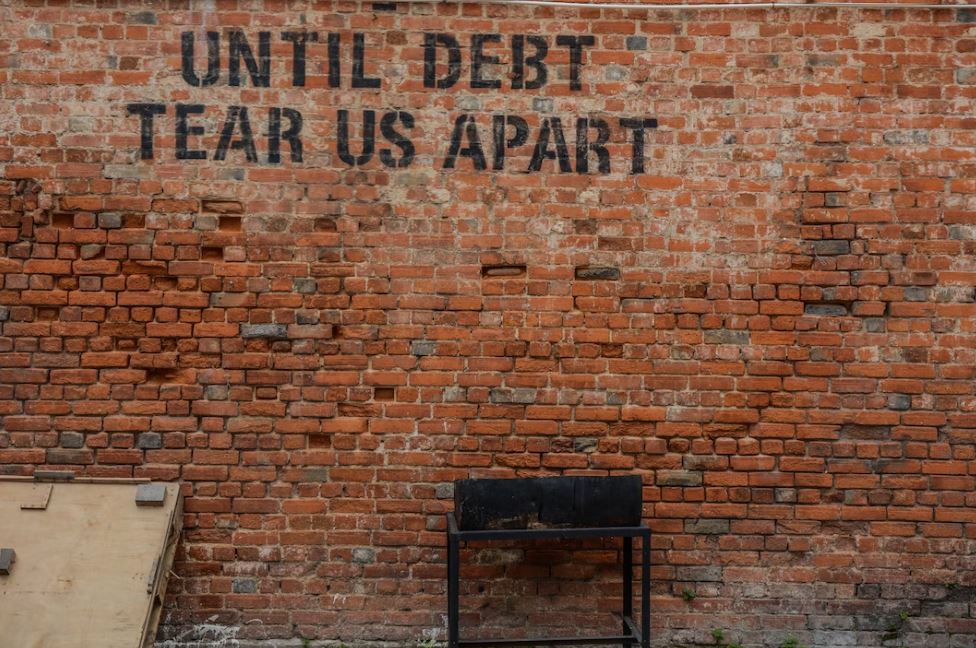

Debt