-

Housing

The January chintz-fest in asset prices is starting to look a little frothy given news that previously do-not-touch-with-barge-pole assets such as triple-C rated credit are now back in vogue. Yields more broadly continue to plunge as FOMO takes hold and bankers are back strutting the coop. Stung by the paucity of the 2022 bonus pool, they are out pushing new deals in speculative credit. And despite the messy macro-outlook, they are finding buyers. Exuberance is rife, too, across equity land; look no further than the 20%, super-sized, January rally in the shiny ARK Innovation ETF. Albeit a rally that leaves it 75% lower than its 2021 peak, such was the bush fire of capital in profitless tech last year. Mike Roman, CEO of the sprawling, fingers-in-pies conglomerate, 3M sounded a note of caution though. In lowering guidance and firing 2,500 colleagues he talked of “rapid declines” in many consumer facing markets; a decline that “accelerated” into December. Ho hum. The cold data, meanwhile, continues to give those whose loiter by the water cooler, invading personal space with white-lipped warnings of an imminent recession, something to coo over. Flash PMIs continue to reflect economic contraction and the Conference Board’s index of leading indicators has just printed a six-month decline so fast, it has never not been followed by a period of soup, board games and drizzle-flavoured staycations. The FED though, continues to vex over a labour market – despite many tech companies cutting fat put on during the pandemic boom – that is as tight as a father-of-four in a mountain restaurant. Quite why all the hand wringing over a recession remains a moot point; in the long run, they tend to clear decks and usher forth periods of sustainable economic expansion. That said, whilst there are many things to watch, there may be nothing more important than housing; a magnificent global bubble that is starting to hiss air. US equities remain somewhat expensive, but that is not the case for Europe and emerging markets. Housing though, is a different story. With the blow-off in house prices last year the multiple of household income to buy a home in the US sits at around 6x, a level that may be above the record of the 2006 bubble, but a level that is a long way from the gaudy multiples found in places like Vancouver, London, Sydney, and Shanghai; multiples which range anything from a unpalatable 10x, to a knee-knocking 20x family income. The problem for the wider economy then, is that housing busts take much longer to play out than the trouser dropping moves in assets such as equities. We’re talking years, not months. Six years in fact – peak to trough – in the case of the most recent GFC debacle. Housing is also much more of a middle-class thing, and a middle-class thing financed by mountains of debt; debt that is fast being repriced as rates race higher. Perceptions of wealth, and retirement plans, are also tied up in the sticker price on Rightmove. Out in Canada and Australia, prices have started to crack. Canaries in the mine, perhaps, on the ballyhoo of an asset that has been fuelled by a decade long ZIRP bonanza. Or the trashing of housing stocks last year, means it’s all ‘in the price’? Time will tell. Those hoping for a pivot from the Fed, meanwhile, may pause to consider the recent moves off the lows of a variety of ‘stuff’: Iron ore +45%, copper +35%, aluminium +35%. Corn +20%, the list goes on. Moves that, when it comes to the data, are all incoming. Thud thud thud. Maybe best to turn the screens off, and go walk the dog.

-

Oil

With some high profile names giving the pow-wow a miss this year, there is a sense that the annual Davos brouhaha is losing its marque status amongst the much written about jet setting global ‘elites’. Flying in on private jet to chitter-chatter and schmooze over pink champagne and butter-glazed vol-au-vents is very Duke of Sussex, and risks a whole load of trolling on social media. That a ticket behind the velvet rope reportedly costs $250k also jars somewhat in the context of the rest of the world feeling the brutal inflationary shake out of the extravagant, post-GFC, fiscal and monetary largesse. All told, the coverage appears a bit more subdued this year. What caught the gaze this week then, was the Bank of Japan Governor, Haruhiko Kuroda, who, against hyped up expectations, gave it a big ‘nothing-to-see-here’ as he announced that he was making absolutely no changes to the current strategy of yield curve control. That changes are needed explains all the hype, but any stepping back from all the bond buying will be on the watch of his successor. Providing there are any applicants. Those who thought a move was coming, got burnt. Also slipping out on the wires – to less fanfare – was news that the International Energy Agency revised up its oil demand forecasts. Up it goes. This despite all the recessionary warnings of many a high profile commentator. With flight data out of China speaking to huge pent up demand to don the Ray Bans, coupled with falling Russian output, subdued capex, and brokers ripping up box-fresh European recession calls, a hot bid returned to the oil patch, pushing prices up through the 50-day moving average. Speculative money, watches and waits. If China continues to ‘normalise’, the IEA may not be done with revising those forecasts. The bid will persist. And don’t bank on US shale coming through as the vaunted swing producer. Pioneer CEO, Scott Sheffield, recently whispered that “the aggressive growth era of US shale is over“. No one is interested in adding rigs. No one. And all this set against the shifting sands of geopolitics with Bloomberg reporting that Saudi Arabia is now very keen on selling oil in other, non-USD currencies; and the unlikely foursomes pairing of Russia and Iran, apparently exploring the development of some sort of stablecoin backed by gold. The talk may be in Davos but the action is, increasingly, elsewhere.

-

Va-va-voom

Quite what happened over the festive break is anyone’s guess, but market players have returned to their desks with some va-va-voom in the belly to send risk assets off to a flyer. Pin any explanation on the move you want, but the most popular appears to be the well-worn suggestion that inflation is cooling and so the Fed will be less aggressive in their approach to monetary policy than the all-in, wide-eyed hike-fest of 2022. So then, lots of buying and selling, although given the price action, a lot more buying. It feels though, a hollow rally, to which bear markets are prone. Stocks labelled ‘low quality’ have done well – see Peloton, Oatly and Coinbase for details – so too those whose valuations come wrapped in velvet. The narrative of slowing inflation is hard to challenge, the question of where it ends up perhaps harder to answer. Could it stop at 2% as those pulling the monetary strings hope, or does it plummet and go negative? One of the most unpopular positions for the year, though, might be for inflation to slow, then rip back. Whilst the market appears to think the Fed are all talk, a second inflationary wave either this year or next might scatter the pigeons. Oil has rattled back to levels that no longer interests the mainstream media, but that may not persist given depletion, exploration, and demand dynamics. See too Dr Copper, quietly breaking out on the chart. When stacked up against the lagged effect of last year’s rate hikes, the widening cracks in the housing market, and many leading economic indicators flashing red, the early flurry of the year has had surprising breadth but is likely based more on overly bearish sentiment and stale positioning and less, perhaps, on fundamentals that will get the party going full hog again. Reporting season kicks off this week. Reality may well beckon.

-

Jig

As the clutch goes in on the trading year, there is much to consider. A year defined in most part by the Ukraine war, but coloured by the implosion in all things cryptocurrency, Elon Musk and governments, led by the little bit ‘ooh-err’ Truss/ Kwarteng hit squad, that appear to be struggling to handle the repercussions of a decade long binge on free money. Year-head pieces lead on the imminent recession. That this appears to be the most expected recession in recent memory, led by the not-seen-before inversion of Bloomberg’s patched together global yield curve and other forward looking economic indicators, suggests that if there is one certainty it is that it won’t come out the oven as expected. Economists have form, and it’s not calling it right. So, if a mild recession is expected and ‘baked in’, the options are either: no recession, or deep recession. Take your pick. The other curiosity is on inflation. It’s slowing, no question; mathematically it must slow. That prices remain at punishing levels for a squeezed consumer appears not to matter, the rate it is slowing. Some even suggest it’s about to go down as quick as it’s gone up. That Chairman Powell admitted this year, after a particularly uncomfortable double-digit print, “we understand better how little we understand about inflation” was refreshing, but not something to inspire confidence. What furrows the brow though, is that if inflation does tip lower, their appears to be a widespread expectation that it will stop at the much longed for 2% rate, and then settle and continue as is. That the 2% target was introduced by an off-the-cuff remark on TV by a New Zealand Central Banker in 1988 is surprisingly overlooked. Move along, nothing to see here. The real world is not so neat, which explains why some market gurus have suggested it might not stop at 2%. As per the oft cited pendulum, it swings beyond expectations both ways. Up and down. History also shows inflation often recedes, pauses, and then goes again. And goes hard. All told, if the most powerful Central Bank doesn’t really understand inflation, there’s not much hope for everyone else, but there is no doubt the lagged effect of the spectacular 2022 rate hike fiesta will bite through next year. Given how fast those hikes have come through, they could bite quite hard. Expect corporate earnings to be crushed, more monetary bazooka-ring and an ensuing, frantic blow-off top in risk assets, a la Michael Flatley, before a whizz-bang-pop puts a large full stop to the era of policy experimentation and consumption driven excess. After that, it’s possibly a sober story of real assets, sovereign default, and a multi-year run for selected emerging markets. Amongst, many other, hard-to-predict events.

Happy Christmas.

-

Huff n puff

Whilst the market choked back its exuberance on a ‘softer’ inflation print this week in anticipation of some tight talk from the FOMC, it appears – despite all the huffing and puffing – nothing much has changed. Inflation is cooling, but it’s still gunning at a wide-eyed 7% clip and, with a labour market as tight at the 49ers defence, the hawks claws on the committee are out. Rate hikes might be cooling off the super-sized 75bp serving, but the trajectory is still up. And may stay up for some time. Commentators, meanwhile, jab fingers at the fast falling price points in many categories. Indeed, auction data suggests used car prices are about to see biggest chop to prices in decades. Bloated inventories weigh too, leaving said commentators muttering about outright deflation. Given J-Pow spent almost ten minutes talking about the hot-hot labour market, it remains a key focus to paring the still stubborn services inflation. That said, citing forward looking market indicators some suggest that the jobs scene is not so tight as widely believed and, by Q2 next year, non-farm payrolls will turn negative. Gulp. All told, the huffing puffing is set to continue. Also sliding out on the wires this week, but perhaps lacking the collective huff and puff, were two other items. The first was the IEA gazing at the moving plates of the market and raising oil demand forecasts for 2023. This, despite, the widespread recession ‘narrative’. Those in the know now think demand will hit 101.6 mb/d. Set against a tightening of the taps at SPR, the shale cohort under-clubbing, China back making moves on the floor and inventories low, the recent softening of the oil price may soon reverse and, potentially, rip back higher. Double gulp. The second release pertained to the Federal deficit, which hit another record. A whopper. Up and up it goes. With tax receipts falling and interest payments soaring, the nagging question of who is going to fund the whole beanfeast into a QT-toned 2023, is one that sulks quietly in the corner. With no mistletoe in sight.

-

Super cycle

It’s cold. As winter sets its stall up in Northern Europe the heating has been switched on. When it’s cold, nothing else really matters. Not the mortgage, not the rail strikes, not even how to stop Mbappe. What matters is getting warm. Ironic then, as the frigid arctic air has arrived, the oil price has turned negative for the year. Whilst pump prices have begrudgingly been easing on the forecourts, the wider energy ‘issue’ has not gone away. Storage tanks across Europe may be brimming, but will quickly get drawn. Demand is constant. Indeed, globally, set to rise. And tanks will need refilling. However well-argued the case is for renewable power like solar and wind, there are times when the sun doesn’t shine and the wind doesn’t blow. See much of Northern Europe for details where, in the likes of Germany, after decades and billions of euros of renewable investment the coal plants are turned up to the max. Hmm. Framed by the EU decision in the summer to classify new nuclear plants as ‘green’, thereby unlocking the gates for many investors, it is harder to find a sector that has seen more positive news flow in the past twelve months, than nuclear energy. Country after country has announced plans to build more reactors, big and small. Even in Japan, long scarred by the meltdown at the Fukushima Daiichi plant in 2011, is ramping facilities back up. Such is the need for reliable, baseload power. Where it gets interesting, is turning to the supply set up for uranium. Simply put, there is not enough to go round. And that’s now, today, before the industry doubles in size as per the forecasts of the IEA. Watch how utilities are set to scramble to lock in long term contracts before Sprott buys it all up. The word super cycle gets thrown around willy-nilly, but such is the size of the long-term supply deficit, if there is one market where it might well stick, it’s this one. Uranium – long shunned by financial investors – swaps mittened hands at a spot price of $50/ lbs. It is possibly going an awful lot higher.

-

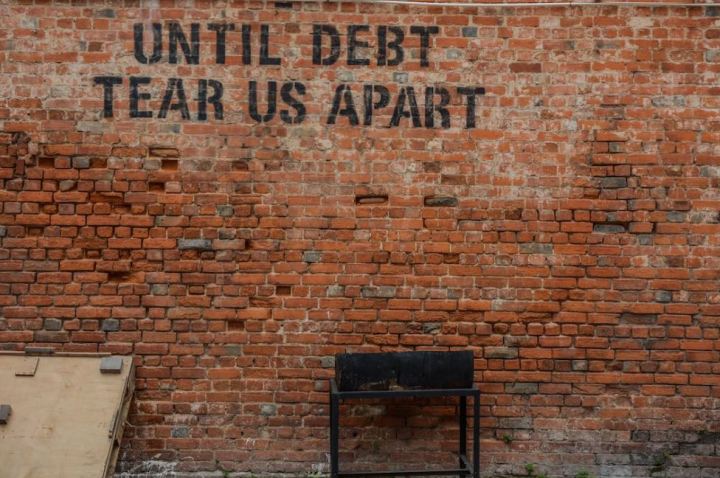

Debt

Concerned about the eye-popping levels of debt in the late 1980s a few fiscal hawks had a whip-round and put up a National Debt Clock in New York City as a sober warning to passers by that America had a problem. It was spending too much. The ‘eye popping’ debt, at the time, was just $2.7 trillion. Today, post a period of fiscal and monetary largesse, it’s through $30 trillion. And going higher. The issue, though, is rates are going up. As rates go up so to do interest payments on all that debt. Up and up. As foreign holders try to shuffle away from their exposure to the USD, they are selling. The Federal Reserve is also selling. So too the Social Security Trust, one reads, a trust for workers to draw upon in the their old age. Some models suggest the Trust will be all out by the mid-2030s. And a growing base of sellers is fanning the coals of the ever thinning liquidity in the Treasury market, which makes it sticky for those doing the buying, or the selling, in any sort of size. Those more glass half full talk up a shallow recession being priced in, egged on by a year-end junket higher off the back of improving data and a more-than-up-for-it consumer; but the debt is not being paid back. And it’s being refinanced at higher rates. No politician wants to cut spending or remove entitlements because it’s unpopular. So they don’t. They carry on. And the clock in Bryant Square ticks higher and higher. Powell may be close to curbing the rate hikes that have so charred 2022, or he may be forced to squeeze the pips a bit more. The market low might be in, or not; but perhaps the real question is not ‘will the Fed pivot?’ but rather ‘are the mandarins 100% finished with their monetary voodoo in all it’s exotic guises? Straight up: ‘yes’ or ‘no’. And if yes, would you put your mortgage on it? Who knows really where it all ends – Japan and it’s stagnant bond market look on wistfully – but the numbers involved when it comes to the debt, are off the clock. The Fed may not actually have any choice. Tick, tick, tick, tick.

-

Blazing

With the market rubbing its thighs at the prospect that the Federal Reserve might start to hit a few irons off the tee, the risk trade is back on. The Santa Rally is real. Up we go. Whilst there was little new out of this week’s show and tell from the Fed Chair, the market reaction speaks of some appetite to run with the hares. Of equal interest, post footage on social media of Chinese government surveillance drones buzzing the high rise apartment blocks, is that some regions are starting to lift up on the lockdowns. One Vice Premier Sun Chunlan announced that the virus was weakening and – hold on to your masks – was no longer such a big deal. Dog walking is back on. Good news. Not such good news for those wanting a lower oil price, though. Traders have pushed benchmark prices lower on the recession narrative but with China back on the pitch there is likely to be a big bid coming to the crude pitch. Recent shenanigans aside, the reality of the oil market – so suggest some analysts – is that demand is about to surpass global oil pumping capacity. For the first time. Ever. Normally when demand gets a bit hot, some producer loosens a spigot, supply comes on, prices ease. No more problem. And yet, and whisper it quietly, there is now a view – long rumoured, perhaps – that OPEC’s current flow of approximately 30 mm b/d is it. There is no more. Talk of excess reserves are not true, as many of the big fields are near exhaustion and if demand runs up, there are no more spigots left to pop open. All that’s propping up inventories is the recent politically motivated move in the US in tapping the so called ‘strategic reserves’. Tapping reserves can’t go on forever. As those who have patiently been positioning for a spike through $200 know, only too well.

-

Cu

There is a risk that the world’s largest copper producer is talking its own book, but there is something a bit ‘ooh-err’ from the perspective of a global economy in the early innings of an energy transition, when the Chairman of Codelco warned an industry conference that there is a massive shortage of copper looming. Massive. Come the beginning of the 2030s, the world will be looking at a deficit of about eight million tonnes. This is much more than the current consensus. Much more. For want of context, current annual demand is about 25m tonnes, so eight is a big deal. To add further context, there was a bit more sucking of teeth courtesy of a sub-heading in a October 8th Bloomberg report: ‘China’s bonded warehouses are all but empty’. Ho-hum. For many years traders have got all revved up about the size of the pile of copper that was stuffed into the corner of a Shanghai warehouse. Some chatted online that it was up to 1m tonnes, hence a persistent bearish force on the spot copper price. However, rumours abound the warehouse is now nearly empty and commercial users are paying up for anyone who can make good on delivery. The market is super tight. When adding in the stores at COMEX and the LME, global supplies fast are approaching record lows, just as the green energy transition starts to stride it out. What adds further season to the soup is the data out of India, a country many believe to be at the same stage in development as China was back at the turn of the millennium and where copper demand is about to sky-rocket. Demand, this year alone, is up 45%. And it’s not going to stop. The story in coming years, is not about China and an empty warehouse in Shanghai, it’s about India. All told, the top man at Codelco could have a point, more so when the only source of supply growth this year is out of the massive Kamoa-Kakula project. Kamoa-Kakula is based in the DRC. The Democratic Republic of Congo. A country ranked 183 in the, much followed, ‘ease of doing business index’. Crumbs.

-

APPL

Having once accounted for nigh on a quarter of the S&P 500, the dominance of the mighty FAANG cohort has taken it square in the chops this year, as the fastest set of rate hikes in history took a size-10 to investor sentiment and pandemic fuelled valuations. All bar Apple that is, a stock roughly equal in market capitalisation to the GDP of EM powerhouse, India. Apple remains, then, the last great Galactico standing in the tech brouhaha of 2022, and left sitting on a velvet covered multiple is a stock that is likely to hold significant influence on the direction of markets into the cold, bitter winds of next year’s now fast-approaching – albeit largely consensual – recession. Intuitively an energy driven cost-of-living crisis is not good context for those selling £1,000 products into a saturated market, but such is the power of the brand and the reach of the ecosystem, if anyone can, Apple can. That said, the videos on social media emanating out of Foxconn’s factory in Zhengzhou of late, should be a cause for concern. Whilst it is hard to get a clear picture, Reuters report today that production could be hit by 30% post the current bout of worker unrest. The person with ‘direct knowledge’ may or may not have any knowledge, such is the trust in mainstream media, but either way, going into the critical holiday season build, such a hit to production may well see analysts start to acting. Start taking a cheese grater to their numbers. If they don’t then the person with ‘direct knowledge’ of the matter, has been telling porkies. Either that, or the troupe of analysts that follow APPL have already got the clutch in on a forgettable year for year-end bonuses, and haven’t heeded what looks like – if true – a fairly stark warning. If there is one earnings report that is likely to matter in the new year, it’s this one.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.